April 2025 Portfolio Construction

By Alfred Lam, CFA, Senior Vice-President, and Co-Head of Multi Asset, CI Global Asset Management

What Happened?

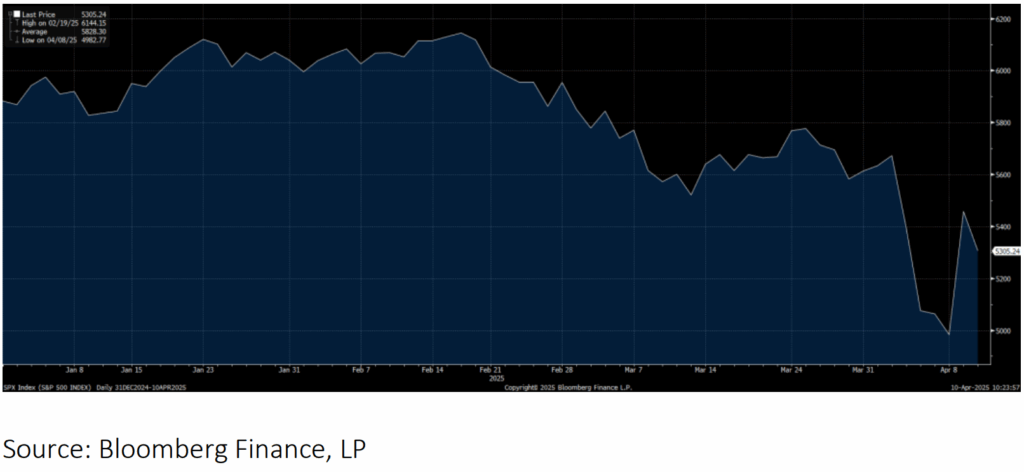

The April 2 U.S. tariffs announcement was a “known unknown.” While it was expected that President Trump would reveal his plan, the specifics were uncertain. Investors had already braced for some level of damage, with the S&P 500 Index dropping 8% from its February 19, 2025, high to the market close just before the announcement. It was widely anticipated that the news wouldn’t be as bad as feared and that the risk had already been “priced in.” Unfortunately, the details were worse than expected, with generally higher tariffs and more countries affected, including the Antarctic Islands, which are home to only penguins.

As is often the case in negotiations, the first offer is rarely the final one. While we expect a worst-case scenario to eventually be avoided—meaning that tariff rates could be renegotiated between the U.S. and the affected countries—the market’s reaction assumed the worst. This was due in part to President Trump’s aggressive stance and the apparent lack of appetite for negotiation among trading partners. As a result, the market experienced a sell-off, with the S&P 500 Index falling another 12% from April 2 to April 8.

The tariff proposal lasted less than 24 hours before the President announced a 90-day reprieve. The S&P 500 rallied by 10% on the news, though it remained 11% lower than its high earlier this year.

The following chart shows the levels of the S&P 500 Index in 2025.