May 2025 Portfolio Construction

By Alfred Lam, CFA, Senior Vice-President, and Co-Head of Multi Asset, CI Global Asset Management and Richard J. Wylie, MA, CFA, Vice-President, Investment Strategy of CI Assante Wealth Management.

Canada’s job market remains divided

Further Canadian dollar weakness likely

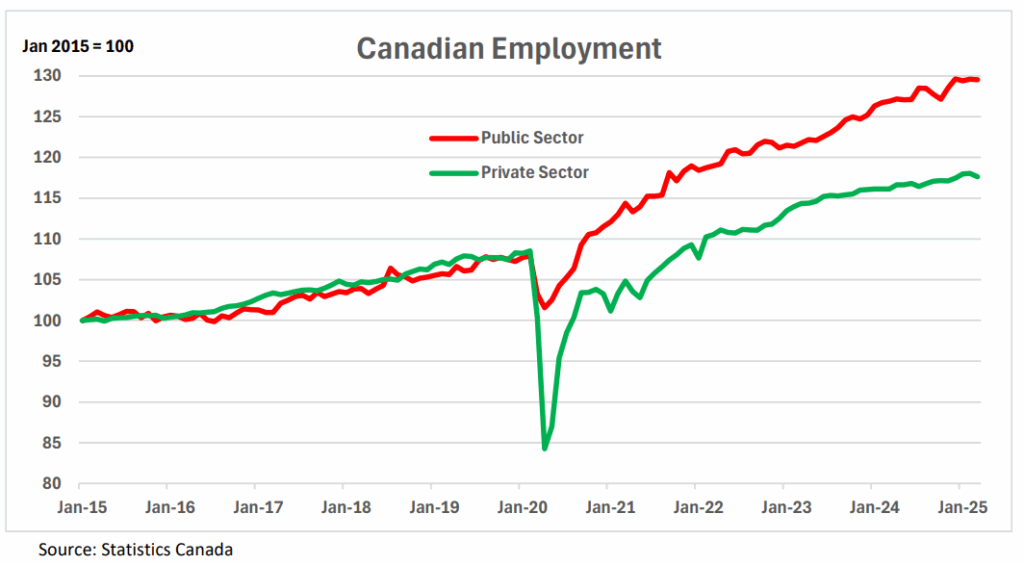

Statistics Canada announced that 32,600 jobs were lost during the month of March, the first decline since July 2024 and the worst figure reported since the massive pandemic-related 203,400 job losses posted in February 2022. In line with the monthly decline, overall annual job growth stood at just 1.7%. However, this March result for broader job growth masks a significant divide that has been witnessed since the economy was shuttered in 2020. On a year-over-year basis, public sector employment was up 2.1%, and private sector employment was up just 1.3% in the March data. The divergence has been in place for a long time. As can be seen in the accompanying graph, private sector employment tumbled 22.4% during the COVID-19 peak. In the public sector the decline was just 5.9%. This minor dip in public employment was quickly recovered over a two-month span. The recovery in private employment took a full 19 months. In addition to the aberration in these figures, population growth has skewed the unemployment rate in Canada. Another significant increase in the working-age population (51,800) was seen in March.

Since the end of 2020, Canada’s working-age population has increased by 10.4%. As a result, the participation rate (the percentage of working-age individuals who were either working or looking for work) stood at 65.2%, the lowest since June 2021 and far below the pre-pandemic peak of 67.3%. This indicates that, as the population has surged, there are now 707,000 potential workers still on the sidelines. A return to 67.3% participation would produce a more realistic unemployment rate of 9.4%, a level consistent with a recession.

U.S. industrial output extends its gains

Following its two-day monetary policy meeting, the U.S. Federal Reserve (Fed) left administered interest rates unchanged, holding the target for the federal funds rate at the rage of 4.25% to 4.50%. This left interest rates at their lowest level since January 31, 2023, with a total reduction of 100 basis points (a basis point is 1/100th of one per cent). This current easing cycle for monetary policy follows cumulative rate hikes totaling 525 basis points between March 16, 2022, and July 26, 2023, which was the most aggressive tightening since the 1977 to 1980 period. Interestingly, the March statement did not mention the potential inflationary implications of the ongoing international trade dispute even though it did state that “inflation remains somewhat elevated.” The Fed’s inflation target is 2.0% and annual growth of the consumer price index rose to 2.4% in March. The on-hold result was anticipated by the market and uncertainty over the potential length of the pause is likely to remain ahead of the next policy meeting, scheduled for May 6 and 7, 2025.

Impact of Trump’s Tariff Proposal on Geopolitics and Global Trade

1. Disruption of Global Supply Chains

The push to “buy American” and for “made in America” products aims to bring manufacturing and sourcing back to U.S. soil. It fundamentally disrupts the global supply chains that have been optimized over decades by business owners with little influence by governments.

These disruptions could result in:

- Higher input costs for U.S. manufacturers relying on foreign components and labour.

- Delays in production cycles due to the restructuring of sourcing networks.

- Retaliatory tariffs from trade partners, escalating into broader trade wars.

2. Inflationary Pressures

With new tariffs, fewer cheap imports, and rising production costs, inflation is likely to rise. Higher inflation, without corresponding wage growth or productivity gains, could:

- Erode consumer purchasing power.

- Prompt the Federal Reserve to raise interest rates faster, potentially stifling investment and borrowing.

3. De-Globalization and Strategic Withdrawal

U.S. companies have long benefited from globalization—accessing cheaper labor, broader markets, and more diverse supply

chains.

A move toward de-globalization could:

- Undermine the competitive advantage of U.S. multinational corporations.

- Lead to loss of market share to more trade-flexible competitors (e.g., EU or Chinese firms).

- Diminish the U.S.’s role in shaping global trade norms and standards.

Disclaimers

This document is intended solely for information purposes. It is not a sales prospectus, nor should it be construed as an offer or an invitation to take part in an offer. The opinions expressed in the communication are solely those of the author(s) and are not to be used or construed as investment advice or as an endorsement or recommendation of any entity or security discussed. This report may contain forward-looking statements about one or more pools, future performance, strategies or prospects, and possible future fund action. These statements reflect the portfolio managers’ current beliefs and are based on information currently available to them. Forward-looking statements are not guarantees of future performance. We caution you not to place undue reliance on these statements as a number of factors could cause actual events or results to differ materially from those expressed in any forward-looking statement, including economic, political and market changes and other developments. Every effort has been made to ensure that the material contained herein is accurate at the time of publication. Market conditions may change which may impact the information contained in this document and it is subject to change without notice. The author and/or a member of their immediate family may hold specific holdings/securities discussed in this document. Any opinion or information provided are solely those of the author and does not constitute investment advice or an endorsement or recommendation of any entity or security discussed or provided by CI Global Asset Management. We cannot guarantee its accuracy or completeness and we accept no responsibility for any loss arising from any use of or reliance on the information contained herein. The pools used in the CI Private Wealth portfolios are managed by CI Global Asset Management. Management fees and expenses may all be associated with investments in the CI Private Wealth portfolios and the use of other services. The pools used in the CI Private Wealth portfolios are not guaranteed, their values change frequently, and past performance may not be repeated. You should seek professional advice before acting on the basis of information herein. CI Global Asset Management is a registered business name of CI Investments Inc. Certain names, words, titles, phrases, logos, icons, graphics, or designs in this document may constitute trade names, registered or unregistered trademarks or service marks of CI Investments Inc., its subsidiaries, or affiliates, used with permission. All other marks are the property of their respective owners and are used with permission. Certain statements contained in this communication are based in whole or in part on information provided by third parties and CI Global Asset Management has taken reasonable steps to ensure their accuracy. Market conditions may change which may impact the information contained in this document. This report may not be reproduced, in whole or in part, in any manner whatsoever, without prior written permission of CI Private Wealth. © 2025 CI Private Wealth, a division of CI Private Counsel LP. All rights reserved. 25-04-1335250-PW (04/25)